Creating an Auction: Sales Tax

Determining the Rate

The sales tax rate is added to each auction within the “Edit Auction" page.

Determining the correct sales tax rate to apply to an auction is critical as sales taxes are a major revenue source for most states, meaning they should pay close attention and levy major fines for errors and omissions.

Affiliates conducting taxable sales are responsible for collecting and submitting the appropriate sales tax amount to the applicable state.

In case of a sales tax audit, it's wise to keep detailed records for every auction, just in case it's necessary to defend the accuracy of the sales taxes paid. Always require tax exempt buyers to provide a tax exempt form for every sale. Sellers may not be exempt for every purchase -- if it's discovered taxes were due for certain items on an invoice and the affiliate has a completed tax exempt form attached to the invoice, it's the buyer who will be held liable for the unpaid taxes and penalties. Without one, it could be the affiliate paying the taxes and penalties.

In order to apply the correct sales tax rate to an auction, the affiliate must know the full street address, city and state of the auction site. Since sales tax rates are subject to change and the rates can vary within the same county, the same city, and even on the same street. It's well worth the minute or two it takes to check the Dept. of Revenue website to make sure the sales taxes you're charging for the auction are accurate.

As an example, below are the steps an affiliate would follow if they wanted to find out the sales tax rate for EQUIP-BID's address: 1501 W 12th St, Kansas City, MO 64101.

Sales Tax Rate Determination

-

On the MO Dept. of Revenue website, access the sales and use tax calculator.

-

On the KS Dept. of Revenue website, access the sales and use tax calculator.

-

Each state's Dept. of Revenue should have their own calculator or information on proper sales tax rates.

-

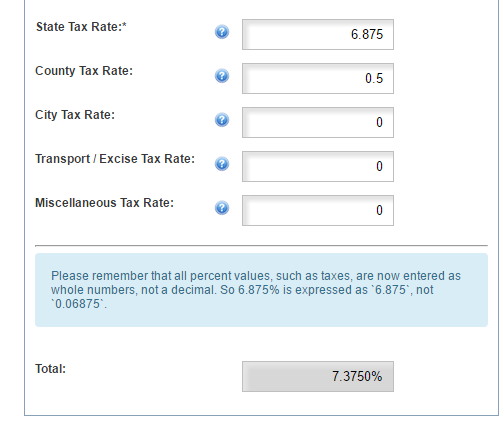

Enter the address, city and zip code and adjust the Effective period (if needed) so the auction closing date falls within the Effective period. The sales tax rate will be displayed — also shown will be a percentage breakdown of the sales taxes charged by the state, county, city, etc. Missouri requires the reporting of the total amount owed so you would only need to enter the total tax amount. Some states require businesses to report their sales taxes using the percentage breakdowns, be sure to enter sales taxes into the auction software in this format so the sales tax reports reflect the proper breakdowns.

As an example, below are the steps an affiliate would follow if they wanted to find out the sales tax rate for EQUIP-BID's address: 1501 W 12th St, Kansas City, MO 64101.

Sales Tax Reports

Affiliates are responsible for the accuracy of the sales tax reports they submit to the Department of Revenue. The sales tax report on EQUIP-BID's website should be used as a tool to verify the affiliate's sales tax records. Below are a few issues an affiliate should be aware of when using the sales tax report on EQUIP-BID's website:

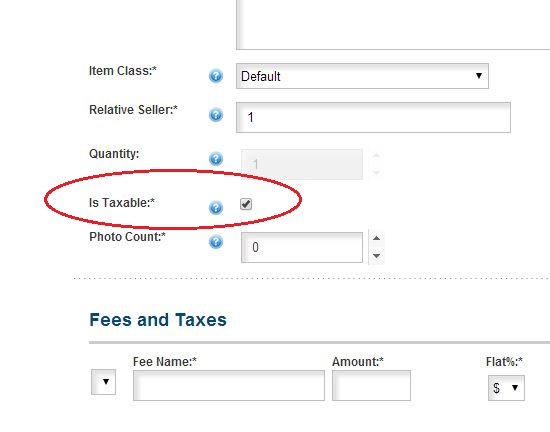

The report is a direct reflection of the information entered into the system by the affiliate — tax rates, tax rate breakdowns, whether a lot is taxable or not, if an invoice is tax exempt, etc.

The sales tax report only shows the sales taxes collected on the bid price and the buyer's premium. If an affiliate adds a taxable fee to a lot or an invoice, the sales taxes collected for the fee will not be included on the sales tax report.

Still can't find an answer? Contact debbie@equip-bid.com and we'll get back to you.