Auctions | Creating | Lot Specifics

Navigate within this document using the links below.

Auction Timeline

Now that you are accustomed to the look and feel of the affiliate login, we will provide you with a quick overview of the auction process along with the specific pages within the Affiliate Knowledge Base that will help you find more detail.

|

Consignment Agreement Signed |

The signed auction contract or consignment agreement is a requirement and should be the first step in the auction process. |

|

Pictures/Descriptions/Videos |

Quality pictures and descriptions are one of the most important factors in an online auction. |

|

A New Auction Created in Equip-Bid.com |

The first step to auction creation is to create the auction shell. This is also the page where auction details will be entered before an auction is published to a live status. |

|

Lots and Descriptions Created |

Lots are created in equip-bid.com. |

|

Images Uploaded |

Images are uploaded into equip-bid.com. |

|

Reserves Programmed |

Reserve amounts must be programmed in the auction description before the auction goes live. |

|

Lot Fees Entered |

Required fees (DMV/DNR registration, rigging fee, etc.) are assigned to each lot prior to publishing to a live status. |

|

Auction Published |

Affiliates are responsible to ensure accuracy before an auction is published to a live status. |

|

Auction Inspection Hosted |

The opportunity for bidders to inspect the items being offered is required for each auction. |

|

Auction Closes |

Auctions will start to close during the specified closing time. Close times for your lots are staggered based on the intervals you chose during your auction setup. Auctions will close individually with at a least a 5 minute interval between each auction. |

|

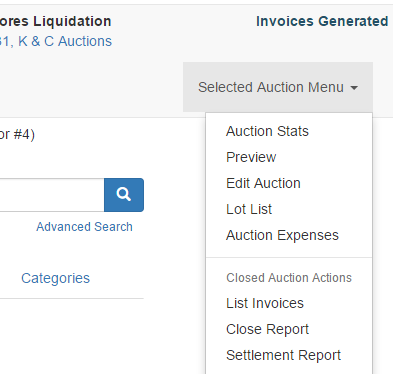

Invoices Created |

Invoices will be available after the close of an auction. Affiliates and bidders may access invoices from their dashboards. |

|

Auction Lots Removed |

Assets are removed during the scheduled removal dates. |

|

Invoices Processed |

Affiliates will process invoices as Paid Cash, Paid Credit, No-Show, or No-Sale within 10 days of the auction closing. |

|

Auction Amounts Verified |

Processed invoices will determine sales tax reports, seller settlements and Equip-Bid Billing. The Close Report is used to reconcile auction proceeds. |

|

Settlement Reports Generated |

Settlements are created to pay out consignors. |

|

Equip-Bid Payments Processed |

Affiliates are billed twice a month for Buyers Premium. |

|

Sales Tax Reports Processed |

Sales tax reports are available in the reports/tools section. These reports are determined by the sales tax rate that has been assigned to the auction and how each invoice has been processed. |

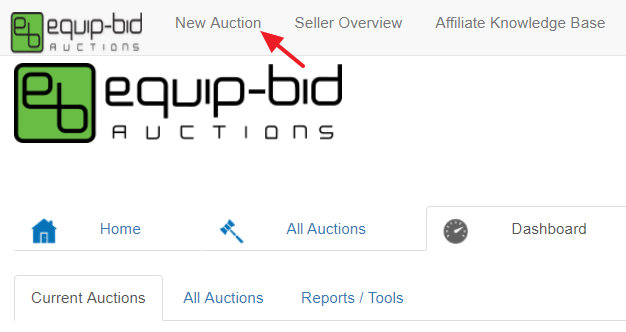

The first step to create an auction is to click on the New Auction button in the upper left hand portion of your screen.

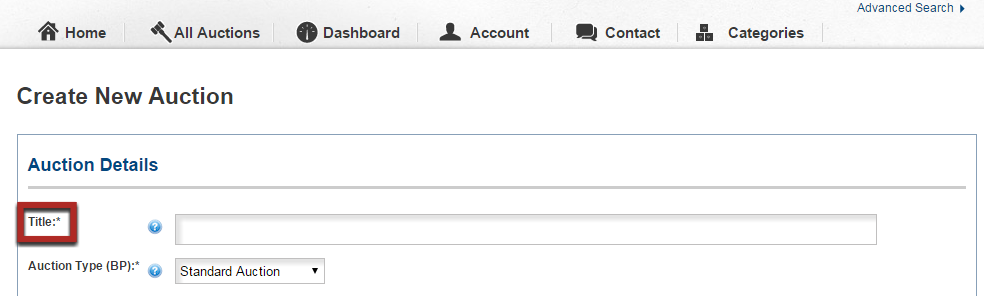

This will take you to the Auction Detail page. The Auction Detail page is where you will enter important auction information such as the title, sales tax rate, terms, etc. This information can be entered at any time before the auction is published, however an auction title is required in order for you to save as a draft. See our Auction Details article for more information.

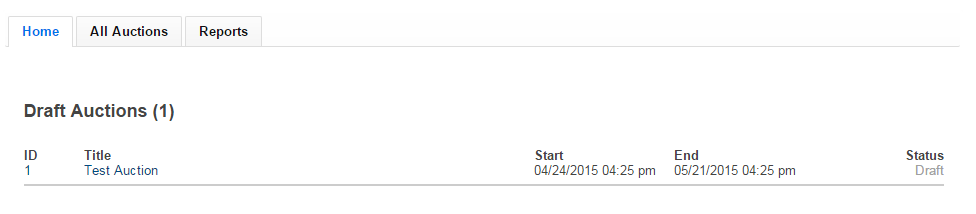

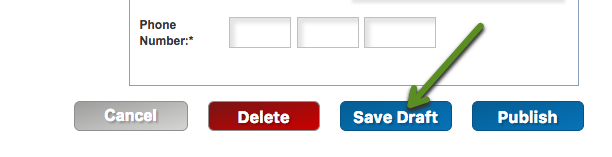

By entering a Title for the auction and hitting Save Draft on the bottom of the page, you have created a new auction shell that can be accessed from your dashboard.

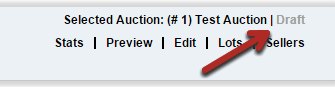

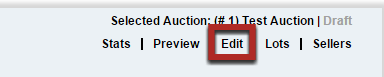

After the auction shell has been created you can start adding items, pictures and descriptions to that auction. You can always go back to edit or continue entering auction details by going to the Edit page within each auction.

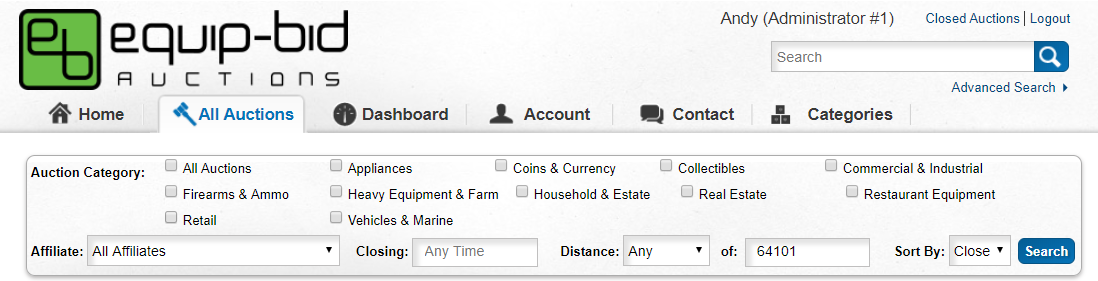

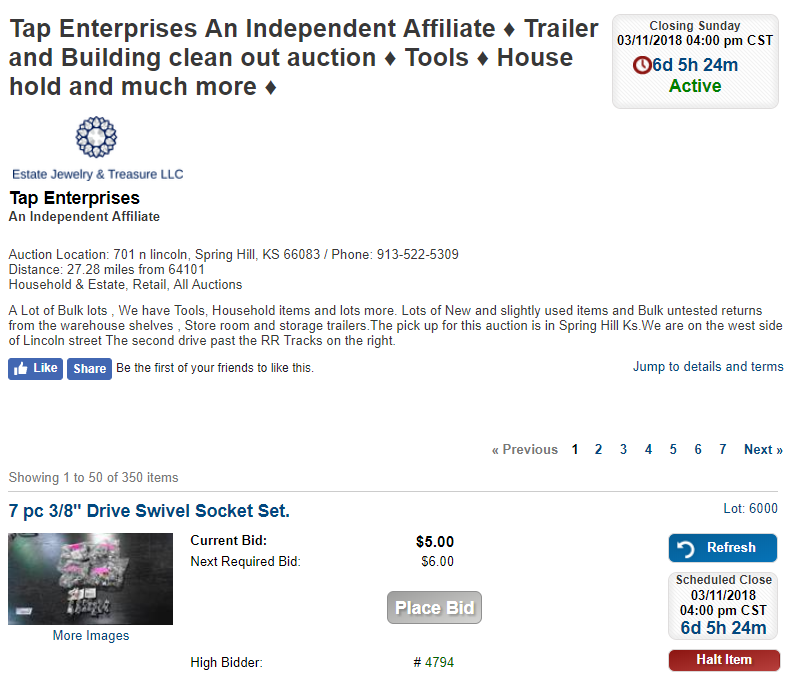

Auction categories are available to help define the contents of an auction. By including auction categories, bidders can easily search for the auctions that they are most interested in.

Each auction must be included in at least one auction category before it can be published to an active status. Always make sure to check the ALL Auctions box as well as the other categories that make sense. No more than TWO categories can be selected.

Auction categories can be adjusted after the auction has gone live at any time.

IMPORTANT: Do not select auction categories that do not apply to your auction in the hopes that it will be found in more searches. This will decrease the effectiveness of this search function and make it harder for bidders to find what they are looking for.

Categories are chosen within the Edit Auction page.

Categories (Examples)

-

Coins and Currency (silver dollars, wheat pennies)

-

Commercial & Industrial (commercial vehicles, lathes, vehicle lifts, pallet racking)

-

Heavy Equipment & Farm (tractors, trailers, implements, farm supplies, NOT for residential lawn mowers/lawn tractors)

-

Heavy Equipment & Construction (skid steers, attachments, building materials)

-

Household & Estate (furniture, electronics, home decor, collectibles, tools)

-

Real Estate (commercial or private property)

-

Restaurant Equipment (mixers, ovens, fryers, etc.)

-

Vehicles & Marine (cars, trucks, 4-wheeler, boats, snowmobiles)

Best Practices

Auction descriptions allow you to give bidders more information about your auction. Information about the seller, items or reason for selling can be helpful information in the eyes of the buyer. (Auction descriptions are entered on the Edit Auction page).

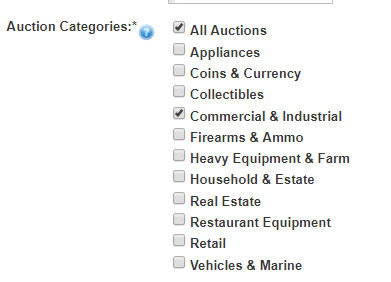

In order to keep the All Auction List clean and easy to navigate, auction descriptions will be stripped of formatting and truncated to 250 characters on the All Auction List. The system will pull the first paragraph from the auction description to show on the All Auction List .

Once inside an auction, the full auction description and original formatting will be present.

Auction details are added to each auction through the Edit Auction page.

Edit Auction Details

You will not be able to publish an auction until all of the required fields are included in the auction details. This chart will further explain each part of the auction details.

Title: A short, descriptive title that is visible to bidders.

Auction Type (BP): Determines the BP added to winning bidder invoices. These options are set by the Site Administrator.

Auction Categories: Identifies the general category/ies of assets included in the auction. Bidders can use this to filter the auctions they see.

Pass Phrase: For use on an invitation-only auction; otherwise leave blank.

Image Base URL: Autofills unless Auctioneer is using Wavebid software (not recommended).

Description: Additional details about the auction; visible only on the main auction page.

Notes: Additional details about the auction; appears on every lot page of the auction.

Terms: Auction specific terms that the bidder agrees to prior to bidding (ex: payment types accepted; appears on every lot page of the auction).

Shipping: Detail what shipping options, if any, are available on this auction.

Bid Increments: Fixed by the Site Administrator.

Auction Start/End: Select the exact start and close times for your auction from the dropdowns.

Inspection: Select the dates and times for your inspection (create a new entry for each day if multiple dates offered) OR check the "by appointment only" box.

Removal: Select the dates and times for your removal (create a new entry for each day if multiple dates offered) OR check the “by appointment only" box (not recommended).

Staggered Closing: Controls how many lots close at one time.

Automate Invoices: Automates the generation and sending of invoices after a sale has ended. This should always be checked unless advised otherwise.

Invoice Footer: Optional text displayed on the bottom of bidder invoices. Can be saved as a template for future auctions.

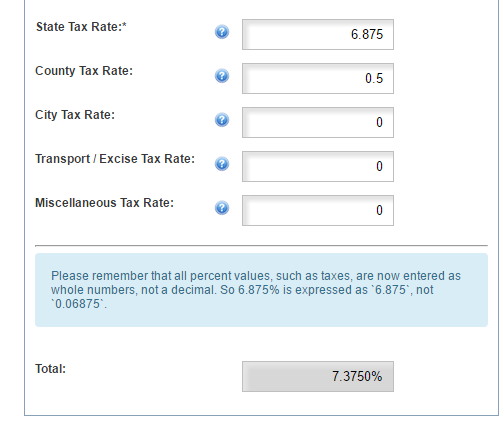

Tax Rate(s): Applicable sales rate to be added to each lot. State sales tax is required; additional taxes are optional. Enter as a whole number and decimal, i.e. 6.875 (not 0.06875).

Total: Populated total sales tax rate. Verify against sales tax rate for the location of the sale.

Address: Provide the exact physical address of the auction (i.e. where the removal is happening). Additional directions may be included in the Notes section of the auction. This can be saved as a template for future auctions.

Latitude/Longitude: This will populate based on address information. Verify the map is correct.

Phone Number: Main contact number for the auction. This will be included on every lot page of the auction and on the invoice that the winning bidder receives.

Select Save Draft at the bottom of the page.

Determining the Rate

The sales tax rate is added to each auction within the “Edit Auction" page.

Determining the correct sales tax rate to apply to an auction is critical as sales taxes are a major revenue source for most states, meaning they should pay close attention and levy major fines for errors and omissions.

Affiliates conducting taxable sales are responsible for collecting and submitting the appropriate sales tax amount to the applicable state.

In case of a sales tax audit, it's wise to keep detailed records for every auction, just in case it's necessary to defend the accuracy of the sales taxes paid. Always require tax exempt buyers to provide a tax exempt form for every sale. Sellers may not be exempt for every purchase -- if it's discovered taxes were due for certain items on an invoice and the affiliate has a completed tax exempt form attached to the invoice, it's the buyer who will be held liable for the unpaid taxes and penalties. Without one, it could be the affiliate paying the taxes and penalties.

In order to apply the correct sales tax rate to an auction, the affiliate must know the full street address, city and state of the auction site. Since sales tax rates are subject to change and the rates can vary within the same county, the same city, and even on the same street. It's well worth the minute or two it takes to check the Dept. of Revenue website to make sure the sales taxes you're charging for the auction are accurate.

As an example, below are the steps an affiliate would follow if they wanted to find out the sales tax rate for EQUIP-BID's address: 1501 W 12th St, Kansas City, MO 64101.

Sales Tax Rate Determination

-

On the MO Dept. of Revenue website, access the sales and use tax calculator.

-

On the KS Dept. of Revenue website, access the sales and use tax calculator.

-

Each state's Dept. of Revenue should have their own calculator or information on proper sales tax rates.

-

Enter the address, city and zip code and adjust the Effective period (if needed) so the auction closing date falls within the Effective period. The sales tax rate will be displayed — also shown will be a percentage breakdown of the sales taxes charged by the state, county, city, etc. Missouri requires the reporting of the total amount owed so you would only need to enter the total tax amount. Some states require businesses to report their sales taxes using the percentage breakdowns, be sure to enter sales taxes into the auction software in this format so the sales tax reports reflect the proper breakdowns.

Sales Tax Reports

Affiliates are responsible for the accuracy of the sales tax reports they submit to the Department of Revenue. The sales tax report on EQUIP-BID's website should be used as a tool to verify the affiliate's sales tax records. Below are a few issues an affiliate should be aware of when using the sales tax report on EQUIP-BID's website:

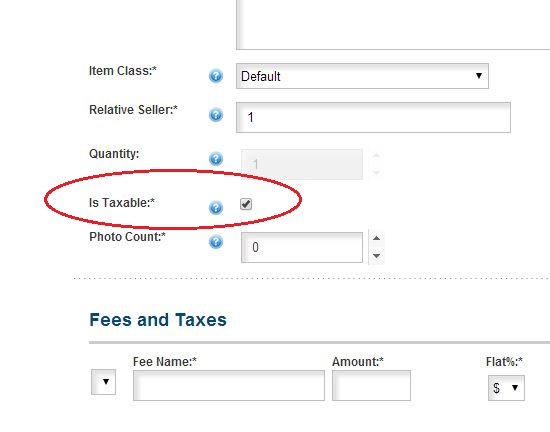

The report is a direct reflection of the information entered into the system by the affiliate — tax rates, tax rate breakdowns, whether a lot is taxable or not, if an invoice is tax exempt, etc.

The sales tax report only shows the sales taxes collected on the bid price and the buyer's premium. If an affiliate adds a taxable fee to a lot or an invoice, the sales taxes collected for the fee will not be included on the sales tax report.

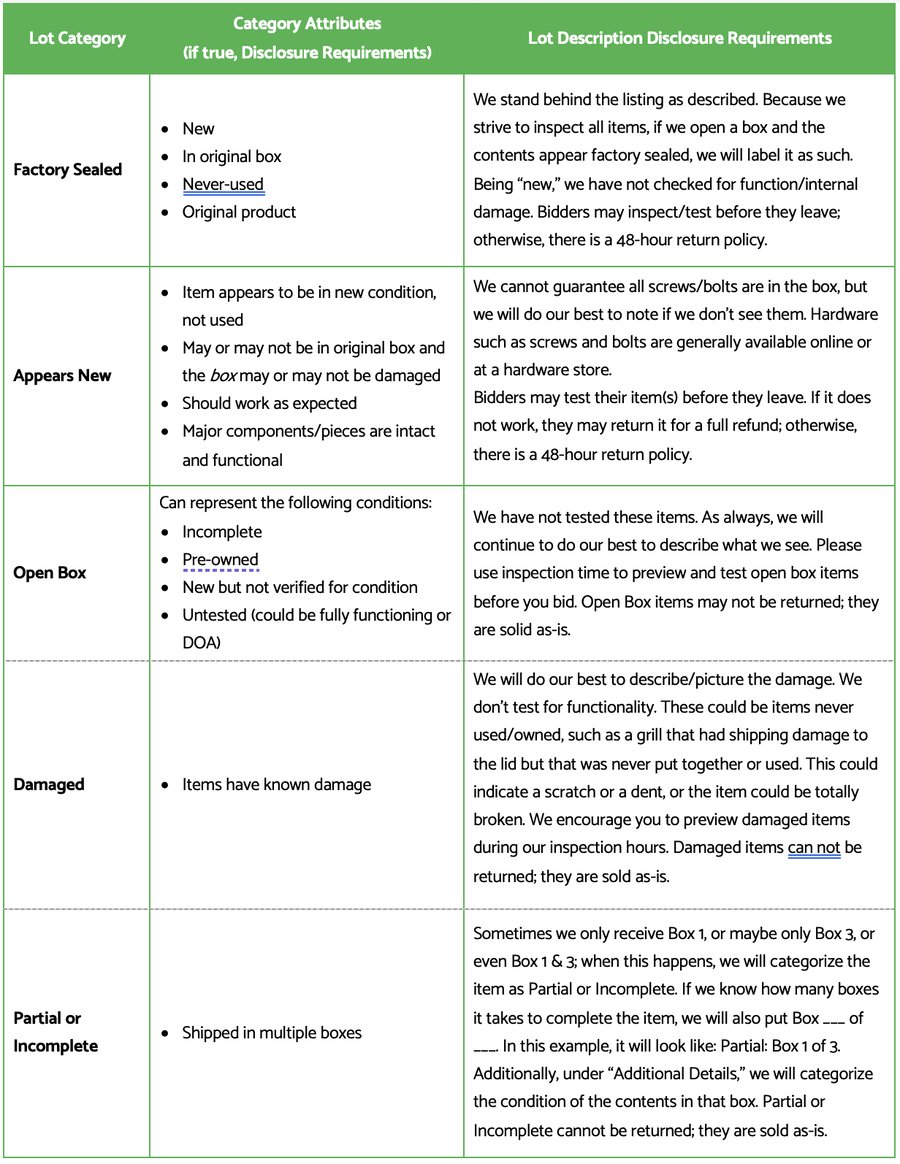

It is assumed lots published on Equip-Bid are complete, undamaged, and in good working order. If a lot does not meet these criteria, the affiliate is required to fully disclose detailed information about the specific lot being sold.

-

List of missing parts

-

Asset damage

-

Malfunctions preventing the asset from operating as intended

-

Any information that would affect the bidder’s ability to accurately determine asset value.

“As Is Where Is" does not apply if the lot description/pictures fail to disclose the actual condition of the asset being sold, even if the true condition of the asset was unknown to the affiliate.

Below is a list of lot categories, the attributes of each category, and the information that must be disclosed if the attribute is true of the lot being sold. Bidders agree to these lot category descriptions in the terms and conditions.

Taken from Equip-Bid's Terms & Conditions: Bidders have sole responsibility for determining an asset's value. Bidders must conduct whatever due diligence is necessary for them to assess value prior to placing a bid. Bidding strategies and amounts should be based on the asset research conducted by the bidder. By placing a bid, the bidder waives any and all claims against the affiliate based on the condition or value of items. Bidders further agree that mistakenly placed bids or buyer’s remorse because the bidder did not inspect the item or because the item is not suitable for a particular purpose will not justify failing to complete the purchase or attempting to obtain a refund on the item.

In order to advertise an auction as “Absolute" or “No Reserve," the following criteria must be met:

-

The opening bid is $10.

-

The intent is to transfer ownership to the high bidder, regardless of the high bid amount.

-

The assets are free of liens or other encumbrances, or a financially responsible party signs a binding commitment to guarantee all liens will be satisfied regardless of the high bid amount.

-

Assets cannot be pulled from absolute auctions once the auction is published.

Equip-Bid’s full disclosure policy requires affiliates to provide lot descriptions and pictures that accurately reflect the condition of the asset being sold. Consequently, the only time it is appropriate to include a stock photo as a lot photo is when the lot is New (defined below):

A lot can only be described as New if it is unused, unopened, undamaged, and is in its original factory sealed packaging. The original manufacturer’s warranty must still apply.

There is one possible exception to the above stock photo policy. If an auction lot doesn’t meet the criteria to be described as New, and it comes disassembled in a box, a stock photo may be used if the item is either too large or too complicated to assemble for a lot photo. However, if a stock photo is used, it is the affiliate’s responsibility to make it extremely clear to bidders that a stock photo has been used and must specifically state how the actual item differs from the stock description/photos, i.e., list missing pieces, describe and photograph any damage or repairs required. Please see the Lot Condition Disclosure Policy for an explanation of lot conditions and criteria.

IMPORTANT: Stock photos are protected by copyright laws. Every stock photo appearing on Equip-Bid.com must be properly licensed and the license agreement must specifically provide legal protection against copyright infringement claims. Affiliates are responsible for ensuring they are licensed to use every stock photo appearing in one of their auctions.

Additional Requirements When Stock Photos are Used

Whenever a stock photo is used for an auction lot, pictures of the actual item being sold must also be included in the lot photos. While a picture of the item being sold won’t be a compelling picture to look at, it does provide bidders with a visual of the condition of the packaging and gives them a good idea of what to expect on removal day if they are the winning bidder.

Lot Description Requirements when Stock Photos are Used

Whenever a stock photo is used for an auction lot, the lot description must specifically include the following information:

-

Lot Condition – using the terms in the Lot Condition Disclosure Policy.

-

Does the lot require assembly?

-

A list of missing parts.

-

Defects affecting the way the item is intended to function.

“As Is Where Is" does not apply to lots missing any of the above information.