Best Practices for Accepting Checks

If you choose to accept personal or cashier's checks as payment from winning bidders, you should take the time to establish a detailed check acceptance policy to help identify and avoid bad checks, and make sure everyone on your team is aware of the policy.

Common check policies include:

-

Checks must be from a local or in-state bank.

-

Checks must be for no more than the purchase amount.

-

Do not accept starter checks, unnumbered checks, or non-personalized checks.

-

Never accept a third-party check (a check made payable to someone other than yourself that has been “signed over” to you).

-

Collect additional contact information - a second phone number, or two phone numbers if no number is printed on the check.

-

Ask for identification, and compare it to the information on the check.

-

If the winning bidder sends someone else to your removal with a pre-filled check, collect the pickup person's ID and contact information.

-

Carefully examine every personal check for information that is essential for cashing the check:

-

Personalization - The customer's complete name and address must appear on the check.

-

Date - The check date must be current. Do not accept post- or future-dated checks.

-

Bank I.D. numbers - The check must have a bank identification number, or routing transit number, that runs across the bottom, along with the customer's account number and check number.

-

Dollar amounts - Both the written and numeric amounts must match.

-

Customer Signature - The check should be signed in your presence and verified with photo identification.

Security Standards

No examination is foolproof and counterfeiters are becoming ever savvier, but here are some common features to look for to help tell a real check from a counterfeit:

-

Checks must be from a local or in-state bank.

-

Genuine checks almost always include a list of security features on the back (watermarks, microprinting, color change, heat-sensitive) that you can verify.

-

Look for a perforated edge. With the exception of government checks, every check has at least one perforated edge.

-

Real checks use microprinting on the signature line. If you can't detect this with your naked eye, consider adding a magnifying glass to your checkout kit.

-

Routing and account numbers should be CRISP, not blurry/bleeding into the paper, and DULL. Ordinary laser printer toner is shiny; the special magnetic ink required for the automated check sorting equipment banks use has a dull finish.

-

Look for the name of the check printing company on the left border of the check.

-

The first few digits of the routing number printed at the bottom of the check can also be found in smaller print at the top of the check.

-

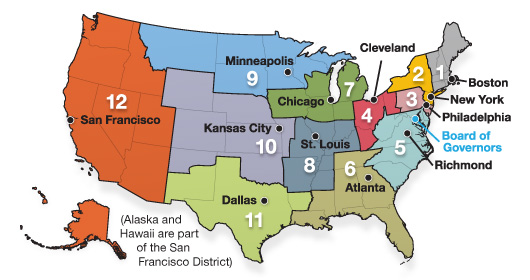

A check's routing number always begins with the Federal Reserve District number for the branch where the account is held (note that some banks use a +20 routing number – so checks from the Minneapolis district could have a routing number starting with 09 or 29). Counterfeiters will often use the wrong Federal Reserve District number to delay the discovery of the forgery. Depending on your location, you may want to familiarize yourself with the Federal Reserve District numbers for the neighboring region(s) as well as your own.

Be aware of what Federal Reserve District you are in. There are twelve different districts as shown below:

When In Doubt

-

If you think a check, particularly a cashier's check, might be a fake, call the issuing bank (look up the bank's phone number online, don't rely on the number printed on the check!) and ask to verify funds. Some banks may not disclose whether funds are available (citing privacy issues), but they should at least confirm that the account number exists - or that they issued the check, in the case of a cashier's check.

-

Wait 10-14 days after depositing a check before spending or moving the funds, to allow the check to fully clear.

-

This goes for cashier's checks, too! Even though the funds are guaranteed for a legitimate cashier's check, a counterfeit may not be detected until it reaches the Federal Reserve.

-

Or, instead of depositing the check into your bank account, take it to a branch of the issuing bank and have it cashed.

Still can't find an answer? Contact debbie@equip-bid.com and we'll get back to you.